Hello fellow savers,

Hello fellow savers,

Thanks everyone for my first 100 likes!

Thanks everyone for my first 100 likes!

It usually involves a long and drawn out explanation of why I am in my current situation and I don’t really like sharing that much personal information with people I just met. My shortened smart ass answer usually involved ” I am a content writer for Diane’s Thrifty Cupboard and I live with my family.” Then I decided to just answer that I am a minimalist. Of course, with further mental examination, what exactly is a minimalist anyway? So, I dug deep into the depths of the interwebz and this is what I came up with.

A minimalist can be pretty much anything you want it to mean. Isn’t society great! It can mean you have no home or car and you carry all of your belongings in your back pack and travel all of the exotic places and live day to day as opportunities arise. Or it can mean you have just enough personal belongings to live comfortably in your tiny house with your family. It means whatever it needs to mean for YOU. The most important part of minimalism is avoiding over consumerism and not being so attached to your belongings that it controls your soul. That’s it in a nutshell.

History has shown us, we as consumerists have become so attached to our belongings that we will kill ourselves to try to keep it; It is incredible once you think about it. Remember Dad working 80 hours a week, so his family can have the best house, car, furniture, clothes that money can buy? That status symbol was ever so important. I am pretty sure that is where the coined term ‘living like the Jones’ came from.

I think now, we are moving away from that mentality. Being happy and content with our soul is much more important than that shiny new Buick. Well, I hope so anyway. Makes you really think how this is going to affect us globally. Consumerism is pretty much what makes the world go round.

I kind of like being a minimalist. I certainly live within my means. No income, no home and very few belongings. I even think opportunist is squeezing in there as well! I can be a hipster with my new millennial lingo and smoke my Vape. (Much cheaper than cigarettes)

I hope this has inspired some thinking on your part, and please like and share!

With Hugs and Hope,

Diane

I was on a social media site the other day, and I saw an ad for an investment app; and since I have to start over and build my equity back up I thought this might be a good place to start. I know absolutely nothing about the stock market and even where to begin on building a portfolio. So, I thought I would try it out and it hit me; this would be a great way to save a thousand bucks!

I was on a social media site the other day, and I saw an ad for an investment app; and since I have to start over and build my equity back up I thought this might be a good place to start. I know absolutely nothing about the stock market and even where to begin on building a portfolio. So, I thought I would try it out and it hit me; this would be a great way to save a thousand bucks!

I am trying out two of them, Acorns and Stash. Basically you link them to your checking account and you can set up weekly or monthly transfers or just do transfers manually whenever you have an extra 5 bucks. Oh yeah, all you need is five dollars to get the account started. If you are leery about linking your main checking account, set up another one with just the money you want to invest and just transfer over your monthly amount. It seems tedious, but if you are worried about overdrawing or being hacked it is a good safety measure.

I have been doing this for about a week now and with 20 dollars I have made .30 cents. I know, you’re thinking, ‘wow a whole .30 cents’ but if you think about it, if you put that same twenty in your regular savings at .01% how long will it take to make that same thirty cents? My guess is not within a weeks’ time!

The format seems to be the same on the two apps I am using, and you can pick stocks at conservative or at higher risk levels. Acorns you are pretty much invested in the portfolio you pick when you set it up, and it rounds up your change from debit card purchases to add to your investment power. Stash you have to manually transfer money into the account, but you can choose different stock options each time you invest more cash. A fun way to save money and learn a bit about the stock market at the same time!

I hope this tip helps you in your success on sticking with your budget goals and saving for a rainy day.

Oh and one more thing, if you use this code for Acorns: http:/ acorns.com/invite/XQMRBS you will get a free $5 for opening a new account; and for Stash: http:/getstashinvest.com/dianeh611

If you have a fun way to save your $1000 please share in the comments or email

I woke up this morning, and it was already 85 degrees outside. Summertime in Texas or anywhere for that matter is gonna be hot! With the mercury rising, so does the cost of keeping our homes comfortable. I have come up with some short term and long term ideas to help keep our budgets cool.

What I can do now; I don’t know about you, but I have to have my morning coffee to jump start my brain. But, a hot cup of coffee doesn’t seem like a good idea when I am already sweltering; so how about yesterday’s coffee that I stored in the fridge and make a frosty ice coffee concoction. Talk about killing two birds; I am saving on coffee and staying a little cooler. Also taking a cool shower and dressing in light loose fitting clothing to help my body stay comfortable. I also let my…

View original post 701 more words

Since I am homeless, jobless and penniless, I have to save every penny I do have, which means I need to be even more creative when it comes to saving money. Just getting basic supplies can be ridiculously expensive, so I have been scouring the internet and found tons of sites that offer free stuff. This gave me the idea of doing a freebie 30 day challenge; and of course I want to share my new found knowledge with you.

Since I am homeless, jobless and penniless, I have to save every penny I do have, which means I need to be even more creative when it comes to saving money. Just getting basic supplies can be ridiculously expensive, so I have been scouring the internet and found tons of sites that offer free stuff. This gave me the idea of doing a freebie 30 day challenge; and of course I want to share my new found knowledge with you.

Here are some freebie sites I found,

http://www.mysavings.com/free-samples/

http://www.getitfree.us/freebies

these are brand specific sites; Walmart and Target also have freebie pages.

http://www.lorealparisusa.com/

http://www.sephora.com/free-beauty-samples

There is always a birthday lurking around every corner, so I found this site:

www.heyitsfree.net/birthday-freebies for a complete listing of every possible freebie you can think of for your special day.

I hope these sites help you in your quest for surviving on a budget and staying within your means to live a stress free budgeting lifestyle. Feel free to add your ideas on my contact us page!

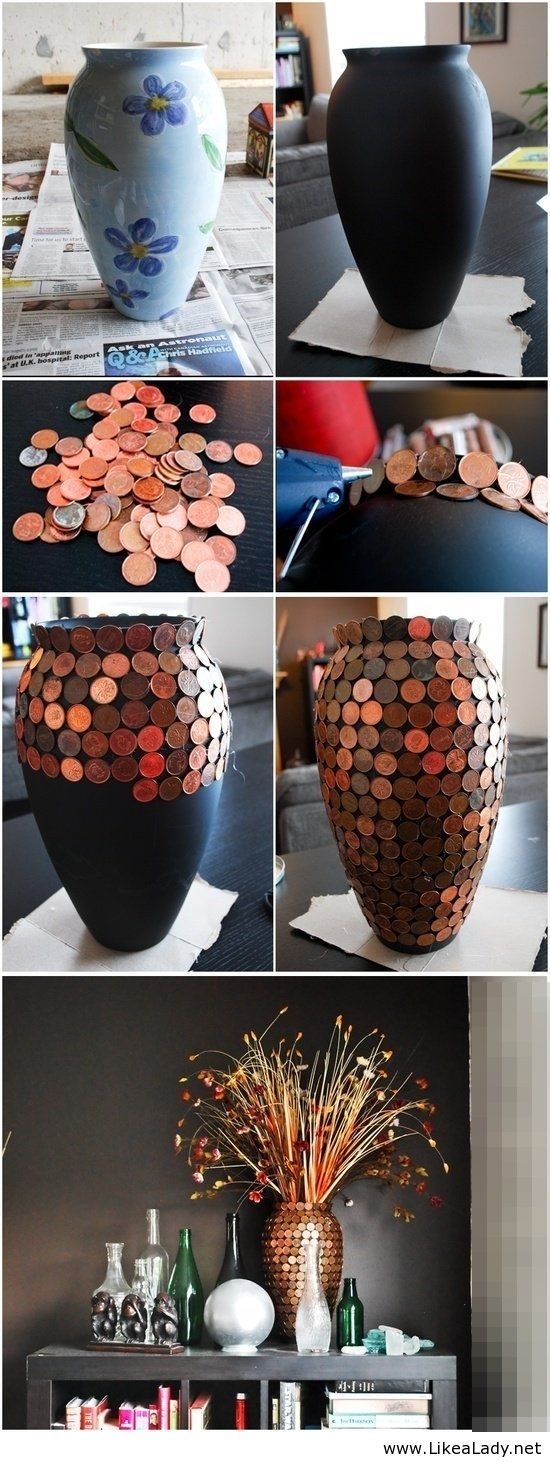

I love doing projects, especially when it comes to creating a unique space in my home on the cheap. Although my skillset is mediocre at best, I do have some favorite cheats to cover up my lack of skills.

Many of my ideas on home interior usually involve stuff lying around my yard, garage, attic, etc; and things I don’t have always come from a thrift shop or the local dollar store. But, what do you do with this stuff and how do you make it work? Well, I am going to share my little secrets to make that project come to life!

All of my secrets are out; now you know what I keep in my tool bag. If you have cheat tools you use and would like to share, please comment below and happy DIY’ing!

I pride myself with the fact that I am pretty good at saving money. My budget is very tight, so I do have to get creative making sure bills get paid and we have dinner every night. I have tried many different tactics, some worked, and some did not.

I have compiled a list for you 5 common mistakes I have made when trying to save money that have completely backfired.

Living paycheck to paycheck is not fun at all, and there are so many creative ways we can save money and build that little nest egg we all need to feel warm and fuzzy at night. If there is any other ideas you can add to this list please comment and subscribe!

Now that we have established a savings account with $1000.00 in a separate account, it is time to start working on the next step; knocking down loans and credit cards. This is where we need to get some pen and paper; write down all unsecured loans and credit cards from smallest to largest.

We are going to work on loans first. If you are like me, I will use the available balance on the credit cards because my budget is so tight. Take the $167.00 that we have been putting into savings and since we are used to that money being allocated away from our budget; and start knocking out those loans. Starting with the smallest loan first, as you pay one loan off work on the next one and work your way down.

Depending on how many loans and balances you have, this will take a while. Be patient! …

View original post 198 more words

Now that the economy is slowly coming back to life, it’s time to clean out our financial closet. If you were one of the lucky ones like me that lost jobs, home and good credit rating; I feel your pain. I spent my share wallowing in self-pity. Now, it’s time to grab ourselves by the boot straps and rebuild. I am going to do a series of steps over the next few posts to give you tips on how to achieve financial greatness.

Step One

A savings plan; According to Dave Ramsey, the first baby steps to financial security is to have a savings account with at least $1000.00 for emergencies only. This is not a savings to blow at the casino or for shopping at the outlet malls; it is for fixing your car that broke down or the deductible to pay for your sons’ hospital bill after…

View original post 303 more words

Funny Blogs With A Hint Of Personal Development

Read, Look, Listen

Your journey of self-discovery

Useful Information About Carefully Selected Consumer Products and Services

Hopeful media tentacle from the hivemind of freedom

Unlock Your Destiny with the Power of Spirituality and Law of Attraction

True wealth is the wealth of the soul

The written word will never be the same...